Development vision

Key risks, opportunities and challenges in the context of sustainable development

Compared to 2009, some of the operating, financial and market-related risks were relatively reduced.

Grupa LOTOS operates in an environment and conditions which entail a large number of risks. The risks inherent in the various areas of the Company’s operations are first identified and assessed, and then reviewed to determine what further measures need to be taken. Compared with the previous reporting period, some of the operating, financial and market-related risks were relatively reduced thanks, among other things, to the efforts aimed to mitigate the impact of the global financial crisis, the successful completion of the 10+ Programme and the implementation of various measures aimed to mitigate the risks identified earlier.

Risks associated with the government strategy for the oil sector. Strategic legal risks

Given Poland’s membership in the European Union, national normative acts passed by the Polish government bodies are not the only source of legal risk, which may also stem from EU directives. In order to identify that risk, Grupa LOTOS keeps track of the trends in EU policies with regard to both proposed and existing directives affecting the oil sector, and cooperates with state authorities responsible for preparing and implementing the government strategy for the oil sector. In addition, the Company is involved in the process of issuing opinions on the draft and effective legislation concerning its area of interest, particularly mandatory stocks of oil and fuels, as well as biocomponents and biofuels.

The key risk in the area of biofuels and biocomponents is still associated, like in the previous year, with a failure by Polish authorities to introduce regulations regarding transposing into national law the provisions of Directives 2009/30/EC and 2009/28/EC of the European Parliament and of the Council of April 23rd 2009, which provide for a higher biofuel content in standard fuels (B7, E10). Due to the lack of legal solutions provided for in the directives and the fact that National Indicative Targets (NCW) are annually increased, Grupa LOTOS is forced to market higher volumes of unprofitable biofuel B100.

In the area of mandatory stocks, it remains unclear in which direction the regulations will evolve. The time when mandatory stocks may start to be taken over from market operators by relevant governmental agencies is unknown, as is the speed of the process. According to the current draft law, the takeover of mandatory stocks is to span ten years.

A serious risk arising from the prolonged legislative process in Poland is the impossibility to predict dates of entry into force of various legal regulations and the related consequences for the Company and the entire industry.

It is also time to take into account the risks associated with the introduction from 2013 of more stringent CO2 emission requirements and with changes to the rules governing the allocation of CO2 emission allowances. The authorities have yet to announce the relevant decisions, which makes it impossible to develop an appropriate model on which specific investment decisions would be based.

Risks associated with changes in and interpretations of tax laws

The legal environment in which Grupa LOTOS operates has for many years been marked by significant instability. Newly enacted regulations and changes in interpretations of the provisions already in force affect the Company’s operations, its objectives, as well as the tax policy and the amount of tax liabilities.

It should be noted, however, that changes in tax laws may be a source of both opportunities and risks for the Company. Grupa LOTOS looks at many new interpretations of those laws as an opportunity to benefit from tax optimisation. There are interpretations which confirm the correctness of the Company’s approach to certain transactions. However, it is equally probable that changes in the interpretations of tax laws may give rise to tax risk in transactions where such risk was non-existent before.

Differences in interpretations of tax laws are frequent, both between various tax authorities and between such authorities and businesses, which leads to uncertainties and conflicts, and in foreign transactions may compromise the Company’s reputation as a reliable business partner. This in turn may prompt the Company to give up profitable ventures or transactions for the sake of fiscal security.

These factors mean that the tax risk of doing business in Poland is significantly higher than in countries where tax regimes are better developed.

Another factor which necessitates a great deal of caution in managing tax risks is related to high potential penalties which may be imposed in the case of a fiscal offence or other violation of tax legislation, and the generally restrictive approach manifested by the Polish tax authorities. When conducting business activities, an entrepreneur has to reckon with the risk that an erroneous interpretation of the law, a human error on the part of its employee or incompetence of civil servants may inadvertently result in tax arrears, as a consequence of which it may face charges of committing an offence.

Given the frequent interpretive changes and enactment of new legal regulations, which are often inconsistent, convoluted or incompatible with the EU laws, Grupa LOTOS reviews and updates its internal procedures on an ongoing basis to ensure compliance with the requirements currently in force and to identify and mitigate any tax risks, and in particular their effect on the Company's financial statements. The process involves employees who actively participate in numerous training courses concerned with tax issues.

In situations where a tax risk related to a possibility of disparate interpretations is identified, Grupa LOTOS avails itself of the right to request an individual written interpretation issued by the Minister of Finance. Compliance with such interpretations eliminates the tax risk to the extent covered by a given interpretation.

Furthermore, Grupa LOTOS, as a member of Poland’s major organisations of employers and entrepreneurs, takes an active role in issuing opinions on draft legislation. This is primarily aimed at improving the quality of tax legislation, but also allows the Company's governing bodies to adequately respond to any changes in the legal environment.

Financial risks

The Financial Risk Management Committee operating at Grupa LOTOS is responsible for supervising the financial risk management process at the Company, seeking to achieve the following objectives:

- increase the probability that budget and strategic objectives will be met,

- limit volatility of cash flows,

- ensure short-term financial liquidity,

- maximise the result on market risk management, given an assumed level of risk.

The key financial risk from the point of view of the Company’s operations is the risk related to prices of raw materials and petroleum products. The Company is in the process of developing a new policy for managing that risk, which will include the objectives connected with the introduction, with effect from January 1st 2011, of a new model of trade in raw materials and petroleum products within the LOTOS Group.

Currency risk is managed in line with the Strategy of Currency Risk Management at Grupa LOTOS, the basic guideline governing that area. The management horizon is determined in line with the rollover budgeting period. The natural currency of Grupa LOTOS’ operating market is the US dollar (USD). Consequently, Grupa LOTOS has a structurally long position in USD on its operating activity. For this reason, it was decided that USD was the most appropriate currency for contracting and repaying long-term loans to finance the 10+ Programme.

Interest rate risk management is connected with the cash flows which depend on future interest rates, in particular the expected schedule of repayments under the loan extended to finance inventories and the implementation of the 10+ Programme, and the resulting interest calculated on the basis of a floating rate (LIBOR USD).

The risk related to prices of CO2 allowances is managed in line with the objectives set forth in the Strategy for Managing the Risk Related to Prices of CO2 Allowances by Grupa LOTOS. The management horizon is determined by the subsequent phases of the Kyoto protocol; the current management horizon runs until the end of 2012.

Liquidity risk management process consists in monitoring the forecast cash flows and available sources of financing, and then matching the maturities of assets and liabilities, analysing the working capital and maintaining access to various sources of financing. Liquidity management is consolidated to cover the entire LOTOS Group.

Measures designed to mitigate the risk of restricting or change in conditions of access to external financing include contracting loans with a wide group of financial institutions, the correct, complete and timely fulfillment of disclosure obligations, analysis and compliance with the financial indicators and covenants, as well as with other obligations towards banks stipulated in the loan agreements. In addition, Grupa LOTOS monitors the credit ratings and general standing of the banks with which it contracts financing.

Management of credit risk relating to counterparties in financial transactions consists in ongoing monitoring of the credit exposure in relation to the limits granted. The counterparties must have an appropriate credit rating, assigned by leading rating agencies, or hold guarantees from institutions meeting the minimum rating requirement. Grupa LOTOS S.A. enters into financial transactions with reputable firms with sound credit standing, and diversifies the group of institutions with which it cooperates.

As regards management of credit risk relating to counterparties in non-financial transactions, all customers requesting trade credit or payment limits undergo verification of their creditworthiness, whose results determine the amount of credit or limits to be granted. Decisions related to evaluation of business partners are made by the Credit Committees, set up within the marketing segment of the LOTOS Group.

In order to ensure that the financial risks are effectively managed and to minimise the risk of errors, all data used to support the process are very precise, and decisions are based on in-depth analyses, in accordance with the operating procedures which are in place.

The financial risk management policies and instruments and the impact of the key risk factors on the individual items of financial results have been presented in the Notes to the consolidated financial statements.

Risks related to the upstream business

Risks related to the upstream business include production and technical risks, exploration risks, risks related to the geological characteristics of the fields or simply weather-related risks. All of them are monitored and appropriate strategies are implemented with a view to mitigating them.

One of the major risks are process risks associated with the production of hydrocarbons. These include risks of oil spills, marine collisions, fires, gas eruptions and other failures. A number of preventive measures are applied, such as leakage testing, monitoring of fire risk parameters and eruption risk prevention, for example by securing the boreholes. Additionally, procedures have been put in place applicable in day-to-day work and when a threat of failure occurs. An important measure helping to reduce the risk is the provision of regular training courses and practical exercises for staff. In the event of an incident or accident, a thorough analysis is conducted, and the event itself is discussed at the training courses held at that time, with a view to preventing its recurrence.

Technical risks are associated with the equipment used to exploit hydrocarbons. It is mitigated through ongoing monitoring of the condition and performance of the equipment, as well as technical supervision (according to the schedule of periodic reviews) and performance of necessary tests. Regular training courses are also provided to staff to teach them how to operate the equipment/components in order to minimise the risk of human error.

The exploration risk follows largely from incorrect estimation of in-place resources. Therefore, such resources are always estimated (in accordance with the SPE 2007 resources classification system) for three scenarios P10/P50/P90, which means that quantities are given that can be potentially recovered with the 10%, 50% and 90% probability. In addition, the internal Chance of Success (CoS) rate is applied when evaluating the potential of the play covered by geological testing. Moreover, in the design phase there is the risk of having to conduct additional, in-depth geological analyses of high potential production plays.

Other risks in the upstream area are related, among other things, to possible occurrence or intensification of phenomena which may cause loss of wells or declines in well rates (e.g. falling reservoir pressures, entry of water), as well as bad weather, which may lead to a suspension of work or production.

Risks related to the supply of raw materials

Grupa LOTOS continues its efforts related to the strategy of diversification of crude oil supplies, focusing on two key aspects of this strategic goal:

- security of crude oil supplies: steady expansion of presence on the international oil market, regular contracting of various types of oil from offshore production, while creating conditions to radically increase their share in total supplies to the refinery, in case of a threat to the continuity of supplies from the main direction, increasing the role of own production,

- improvement of competitiveness: by fully capitalising on the coastal location of the Gdańsk refinery and the possibility to source oil supplies through two independent channels: Russian oil through the Druzhba Pipeline and various types of oil available through Naftoport.

An appropriate selection of types of oil and directions of supplies is the result of optimisation efforts, carried out on an ongoing basis, to maximise the integrated margin.

Risks related to operating activities

The management of risks related to operating activities covers various areas: from process and technology-related risks, to workplace safety and environmental risks, to legal risks relating to the respective areas.

Risks related to implementation of the 10+ Programme

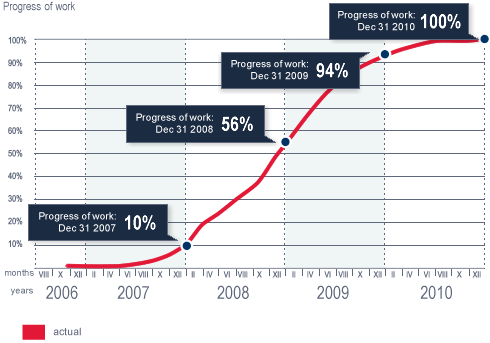

Risks related to the implementation of the 10+ Programme, which were quite significant in recent years, have either markedly diminished or been altogether eliminated. The credit for that is attributable to the mitigation measures applied by Grupa LOTOS with respect to those risks, as well as the fact that the implementation of the 10+ Programme (along with the construction of all its facilities) has now been completed, as a consequence of which the likelihood of the occurrence of such risks is now minimal.

Detailed analyses of major risks in the implementation area of this investement project were carried out, which allowed the Company to determine the best ways of dealing with them. The greatest risk was associated with possible delivery or fitting in of defective installations/equipment and materials, which could necessitate repairs and replacements, driving up costs and causing delays. The measures applied, including the preparation of a list of preferred suppliers and a list of entities with which contracts should be avoided, monitoring of critical equipment, inspection of fixtures, performance of the appropriate amount of diverse testing (e.g. tests of the chemical composition and thickness of selected pipeline components, identification of materials and quality of joints) and compliance with internal standards, allowed us to reduce the above risks. In terms of quality control, the measures undertaken helped to avert events which could have critically affected the project. Thanks to implemented controls, some risks were detected at a stage when it was still possible to eliminate them completely. In the few cases where any of the risks materialised, the scope of control was extended, which allowed to eliminate the risk of similar events in further work. It should be noted, however, that there is still a risk that any latent defects in the materials supplied may be identified during their lifetime. Despite the fact that a majority of the units built as part of the 10+ Programme have already been proven, tested and put into operation, the risk of identifying defects during the start-up and initial period of operation still exists with respect to those units which are currently in the start-up phase. Any such event may disorganise and/or delay the start-up work, affecting the implementation schedule of the entire Programme. Furthermore, in some cases, late detection of such defects, after a facility has already been put into service, may give rise to risks associated with workplace safety, fires and explosions.

The 10+ Programme also involves a number of other risks which have been subject to supervision and monitoring, as a result of which the project has so far been implemented according to schedule and within budget. Currently, the main risk related to the 10+ Programme has to do with the Company’s ability to complete the entire project by the deadlines specified in the loan agreement and perform the required tests.

However, on the basis of experience gained while carrying out the 10+ Programme and managing the related risks, measures were designed to reduce the identified risks, also when new projects are implemented in various areas Grupa LOTOS’ business.

Progress of work under the 10+ Programme

Environmental risks

Grupa LOTOS’ operating activities entail certain environmental risks, the most important of them being:

- risk of failure to comply with the requirements of environmental laws (Polish and EU),

- risk related to shortage of CO2 emission allowances,

- risk of serious industrial failure (described in detail further on, in the section devoted to the process and technology-related risks).

The likelihood that the risk of non-compliance with the legal requirements might materialise is minimised through ongoing monitoring of the Polish and EU laws, efficient implementation of their provisions and taking an active and effective role in the legislative process. Any identified environmental law requirements are notified, in the form of information or orders, to all those at Grupa LOTOS for whom such requirements are relevant. The processes of obtaining permits are carried out with a sufficient time reserve, taking into account the risk that administrative proceedings might last longer than expected, which guarantees that the relevant documents will be obtained in time.

Grupa LOTOS is making intensive efforts to mitigate the risk related to the need to secure a sufficient number of CO2 emission allowances. Legislative changes at the level of Polish and EU laws are monitored on a routine basis. The Company has ongoing liaison with the National Administrator, while applications for new allowances are prepared sufficiently in advance.

For the refining units which participate in the EU Emissions Trading Scheme, including units constructed as part of the 10+ Programme which were commissioned in 2010 (CDU/VDU, HDS, HGU and ASR), the number of allowances will suffice until the end of the current trading period, i.e. 2012. Additional allowances were granted for the CHP, whose emissions have increased in connection with the supply of heat supporting the operation of the above units. Given that the last units covered by the 10+ Programme are being commissioned, in the near future Grupa LOTOS will apply for allowances from the national reserve for the MHC and ROSE units and for the CHP, whose emissions will increase further as the new refinery production units will be connected with the CHP. It is expected that a relevant decision is made by the National Administrator in mid-2011.

Process and technology-related risks, risks related to workplace safety

One of the key risks for Grupa LOTOS, addressed by specially designed preventive and preparatory measures, is the risk of industrial failure. Emergency events may disrupt the work of refining units, cause excessive emissions of pollutants into the environment or accidents at work. To prevent such events, a variety of precautions are taken, such as diagnosing the technical condition of the units and equipment, establishing an appropriate inspection agenda on the basis of analyses, e.g. corrosion reports, using lists of eligible vendors of equipment and providers of technical services, and the implementation of various operational procedures, including with respect to acceptance and inspection of supplies.

Grupa LOTOS also carries out criticality analyses of the equipment, as part of which it identifies and assesses risks and implements appropriate action plans for individual items of equipment, depending on their degree of criticality. All equipment supporting the work of units has been classified on the basis of the following criteria:

- safety for humans and the environment,

- the importance from the perspective of the refinery,

- the importance from the perspective of the units,

- probability of failure,

- complexity of repair.

The classification of a piece of equipment to a specific criticality group determines the selection and application of an optimal strategy for maintenance of its operations.

Installations built under the 10+ Programme are a special case in that respect. As many of these installation have only worked in the refinery for a short period of time, the adequate measures of managing process-related risks described above have not been implemented yet. Additionally, it is possible that defects originating in construction will be identified later. The risks of such defects are analysed above in the subchapter Risks related to the implementation of the 10+ Programme. However, the positive aspect of the newly-constructed installations is the fact that they perform technological processes which have already been performed before at the refinery, therefore it is possible to reserve the processing capacity for such an event. Hence, should any failure occur at any of the installations, it will not have such far-reaching consequences for the entire plant and the rest of the refinery will be able to work without any major disruptions.

A factor contributing to the increase in the risk of failure of the new installations is the insufficient training of staff. To mitigate this risk, a number of steps were taken at the refinery, including employing staff which were to operate new installations well, even up to 2 years, in advance so that the training process could be finished on time. Grupa LOTOS also invested in state-of-the-art training tools – training simulators – which are industrial equivalents of flight simulators applied in aviation. Thanks to them, the staff operating new installations can be trained in conditions which are very close to actual working conditions with a real installation.

The refinery also uses technologies and equipment meeting the BAT criteria (Best Available Techniques). Process units are equipped with adequate safety and security solutions, including multi-layered security systems (prevention, protection and counteraction layers). Alarm, emergency stop and shutdown systems are deployed in order to prevent uncontrolled development of an emergency situation and serious damage to machinery and equipment.

In order to mitigate the effects of the risk, failure response training and exercises are provided on a regular basis to all employees of the refinery, to ensure prompt and effective response to any actual failures.

If an emergency event does occur, a thorough analysis of its causes is performed (Root Cause Analysis). Based on its findings, measures are implemented designed to prevent the recurrence of such failures in future. Information gathered about the various failures and incidents is used in subsequent assessments of the technology-related risk.

Given the nature of Grupa LOTOS’ production processes, workplace safety is an issue of utmost importance for the Company. Many jobs are exposed to hazardous or noxious factors, which is why each job is assessed in terms of inherent occupational risks, including risks related to explosive atmosphere, noise, vibration or presence of chemical and biological substances. On the basis of that assessment, individual and collective security systems are deployed.

New technical and organisational measures are also put in place to ensure safe working conditions for all persons staying and/or working on the premises of and for Grupa LOTOS. Regular checks of the procedures are undertaken and the requirements are enforced. In many cases, the rules implemented at Grupa LOTOS are more stringent than those required by law.

Grupa LOTOS attaches particular importance to raising employee awareness of occupational safety. This objective is being accomplished for instance through a series of above-standard initiatives and programmes designed to promote awareness of the health and safety-at-work issues in accessible and interesting ways. The Company also implements incentive schemes in that area.

All the above activities are designed to ensure safe conditions of the work and processes taking place at Grupa LOTOS, which is a priority concern for the Company.

Risk management in the operating area is also related to limiting the likelihood of failure to comply with the legal requirements applicable to the operations of Grupa LOTOS. This risk is minimised through ongoing monitoring of the Polish and EU laws, efficient implementation of their provisions and taking an active and effective role in the legislative process.

Risk of stricter quality requirements for petroleum products

Grupa LOTOS S.A. keeps a close eye on the proposed new standards and regulations relevant for its production and sales. The source of information about future changes in the quality requirements is Technical Committee 222 at the Polish Committee for Standardisation, responsible for petroleum products and process liquids. Thanks to active participation in the work of the subcommittees of Technical Committee 222, Grupa LOTOS is able to issue opinions on proposed EU standards at the stage of their development.

Grupa LOTOS can also have a say on the quality requirements, especially for motor fuels, through participation in the Polish Organisation of Oil Industry and Trade (POPiHN). The Company’s participation in that body’s work substantially reduces the risks of delayed compliance with future quality standards for petroleum products. In 2010, a change was expected in the quality requirements for gasolines and diesel oils regarding the admissible content of biocomponents. Unfortunately the change, whereby the admissible content of FAME was to be raised to 7% of the total volume, was not effected, and is now expected in 2011. Work is also under way to admit to trading gasolines with ethanol content of up to 10% of the volume. Grupa LOTOS is already prepared for those changes and thus they do not pose any threat to the Company’s continuing as a going concern.

Marketing risks

Risk management in the area of Grupa LOTOS’ marketing activities covers both market-related and financial risks associated with the liquidity of its counterparties. For a description of the Company’s strategy for managing the credit risk of its non-financial counterparties, see the financial risks section.

One of the key marketing risks to which Grupa LOTOS is exposed is the risk of declining margins due to price competition. The most important measure addressing the price risk is the ongoing monitoring of parameters related to prices and margins, in conjunction with the monitoring of sales volumes and results. The Company is planning to introduce tools and mechanisms that will allow it to fine-tune pricing to optimise achieved margins. In addition, in the retail sector, the Company is diversifying into market segments less susceptible to downward pressure on margins due to competition (both existing and potential), while making efforts aimed to foster sustained customer loyalty, for example by enhancing the Navigator loyalty programme at LOTOS stations and the LOTOS Biznes schemes.

Grupa LOTOS also manages the risk of decreased demand. High availability of fuels (increased supply in the domestic market plus imports) is likely to drive down the prices, which in turn may result in lower sales volumes. To mitigate that risk, sales are made through various distribution channels, while the production processes are continuously enhanced.

Risk management in the marketing area is also focused on maintaining uninterrupted supplies of products to the market. At Grupa LOTOS, the process is coordinated by the Supply Chain Management Committee, whose role is to guide the LOTOS Group's operating activities in the area of production, procurement, logistics and sales, in terms of the whole supply chain. Additionally, any logistical constraints are taken into account in the process of operational planning and optimisation. Moreover, the availability times of the distribution centres are constantly monitored.

In order to minimise the risks associated with loss of products as a result of theft or improper handling during storage or transport, agreements are only concluded with eligible suppliers, while the parameters throughout the logistic chain are constantly monitored. Mitigation measures are also taken to address the risk arising from the proposed legislative changes in respect of mandatory stocks, which may increase the costs of logistics.

In order to ensure effective and prompt response to the various risks and emergencies, Grupa LOTOS has developed crisis scenarios for the most strategic areas, including oil supplies, oil processing, fuel production, product storage and logistics.

Costs of implementation of hedging strategies

Many of the planned and implemented risk mitigation measures involve organisational or procedural changes, which usually entail negligible costs. However, some measures require large expenditures. In such cases, the ALARP principle (“As Low As Reasonably Practicable") is applied, whereby risks are reduced to a level as low as reasonably practicable. Risks are considered acceptable if it is impossible to reduce them any further or if the costs of their reduction outweigh the benefits to be gained. Any hedging strategies, including plans to mitigate risks or transfer them (e.g. by way of insurance), are therefore implemented following careful analysis, focused especially on the costs that would need to be incurred.